1

Please refer to important disclosures at the end of this report

1

1

Neogen Chemicals Limited (NCL) is one of the leading Indian manufacturers of

bromine & lithium based specialty chemicals. The company manufactures

specialty organic bromine-based chemical compounds (bromine compounds) and

other specialty organic chemical compounds coupled with specialty inorganic

lithium-based chemicals compounds (lithium compounds).

Marquee client base with long relationships: Over the last 25 years, Neogen has

established a customer base of about 1,363 customers, of which about 1,237 are

domestic customers and 126 are international customers. Neogen has

established relationship of over a decade with large producers of Bromine

Source and Lithium Source such as Divi’s Lab, Austin Chemical, Thermax and

Voltas.

Focus on advanced specialty intermediates which offer higher value addition:

Over the last few years Neogen has not only been focusing on manufacturing

Bromine Compounds but also combining bromination with other chemistries

to make advance intermediates, which otherwise would have been

manufactured by its customers internally. Such forward integration has

enabled Neogen to offer higher value addition and generate higher margins

along with increased profitability.

Specialized business model with high entry barriers: Company’s products are

used for specialty applications in the pharmaceutical, agrochemical, aroma

chemical, construction chemical, specialty polymer and electronic-chemical

industries where they are used to manufacture high value proprietary and

specialized products. Given the nature of the application of their products,

company’s processes and products are subject to, and measured against,

exacting quality standards and stringent impurity specifications this technicality

makes tough entry barrier for other players to enter in segment.

Outlook & valuation: In terms of valuations, PE works out to be 31x annualized

FY19 EPS of `7 post listing (at the upper end of the issue price band) and there is

no listed peer available with similar products for comparison. Moreover, NCL is

operating at optimum level of utilization and company has not planned any

defined capacity expansion in near term. Therefore we believe investors should

wait for price discovery before taking any investment decision. Hence, we have

NEUTRAL view on the issue.

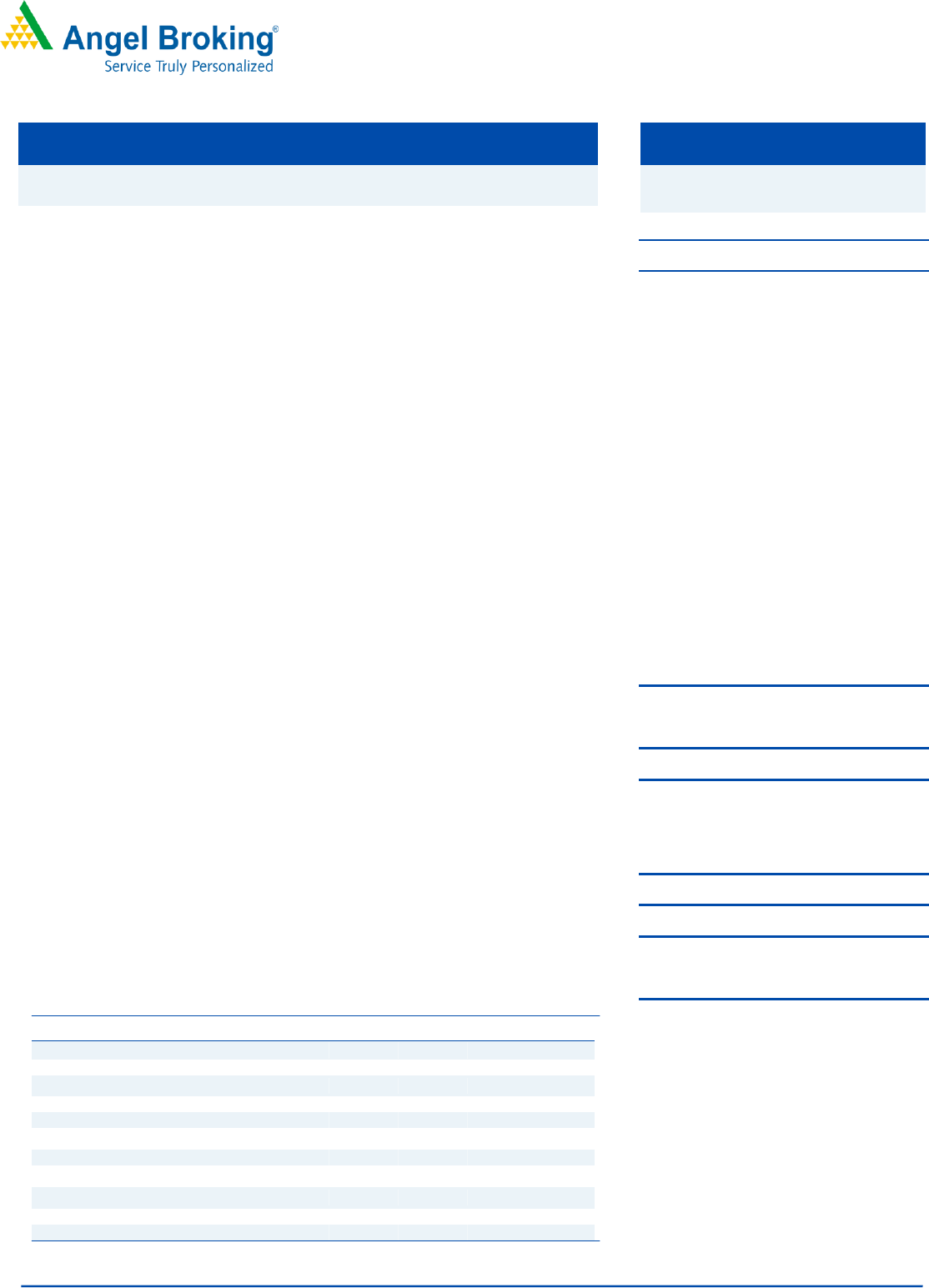

Key Financial

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E*

Net Sales

91

109

121

164

212

% chg

-

19

12

35

29

Net Profit

5

5

8

10

16

% chg

-

2

48

37

57

EBITDA (%)

13.8

13.0

16.5

17.7

18.5

EPS (Rs)

2

2

3

4

7

P/E (x)

99

97

66

48

31

P/BV (x)

21

18

12

9

7

RoE (%)

22

19

18

21

27

RoCE (%)

38

38

22

28

32

EV/EBITDA

40

36

27

19

14

Source: Company ,Angel Broking,*Annualized

Note: Valuation ratios based on post--issue outstanding shares and at upper end of the price band

NEUTRAL

Issue Open: April 24, 2019

Issue Close: April 26, 2019

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 70%

Others 30%

Post Issue Sh areholdin g Pattern

Post Eq. Paid up Capital: `23.33cr

Issue size (amount): *`131cr -**132.35

cr

Price Band: `210 - `215

Lot Size: 65 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`490cr -

**`502cr

Promoters holding Pre-Issue: 96%

Promoters holding Post-Issue: 70%

*Calculated on lower price band

** Calculated on upper price band

Book Bu ilding

Issu e Deta ils

Face Value: `10

Present Eq. Paid up Capital: `20.85cr

Offer for Sale: `62cr*

Neogen Chemicals Ltd.

IPO Note | Specialty Chemicals

April 22, 2019

2

April

22,

201

NCL | IPO Note

April 22, 2019

2

Company background

Neogen Chemicals Limited (NCL) is one of the leading Indian manufacturers of

bromine and lithium-based specialty chemicals. Specialty chemicals are those

chemicals that impart different properties to a variety of products (i.e. the effect that

specialty chemicals have varies based on the product) and have a high degree of value

addition. Specialty chemicals are, also generally, in the Indian context, manufactured in

smaller volumes when compared to non-specialty chemicals. NCL manufactures

specialty organic bromine-based chemical compounds (Bromine Compounds) and

other specialty organic chemical compounds coupled with specialty inorganic lithium-

based chemicals compounds (Lithium Compounds). Company commenced its business

operations in 1991, at Mahape, Navi Mumbai manufacturing facility with a few

Bromine Compounds and Lithium Compounds. Over the years, NCL has expanded its

range of products and, presently, manufactures an extensive range of specialty

chemicals which find application across various industries in India and globally. As on

February 28, 2019, Company had manufactured an aggregate of 198 products

comprising 181 organic chemicals and 17 inorganic chemicals.

Issue Details

The company is raising ~`62.35cr through an offer for sale and fresh issue of `70cr in

the price band of `210-215. The fresh issue will constitute ~13.95% of the post-issue

paid-up equity share capital of the company, assuming the issue is subscribed at the

upper end of the price band. The company is offering 0.29cr shares that are being sold

by promoters.

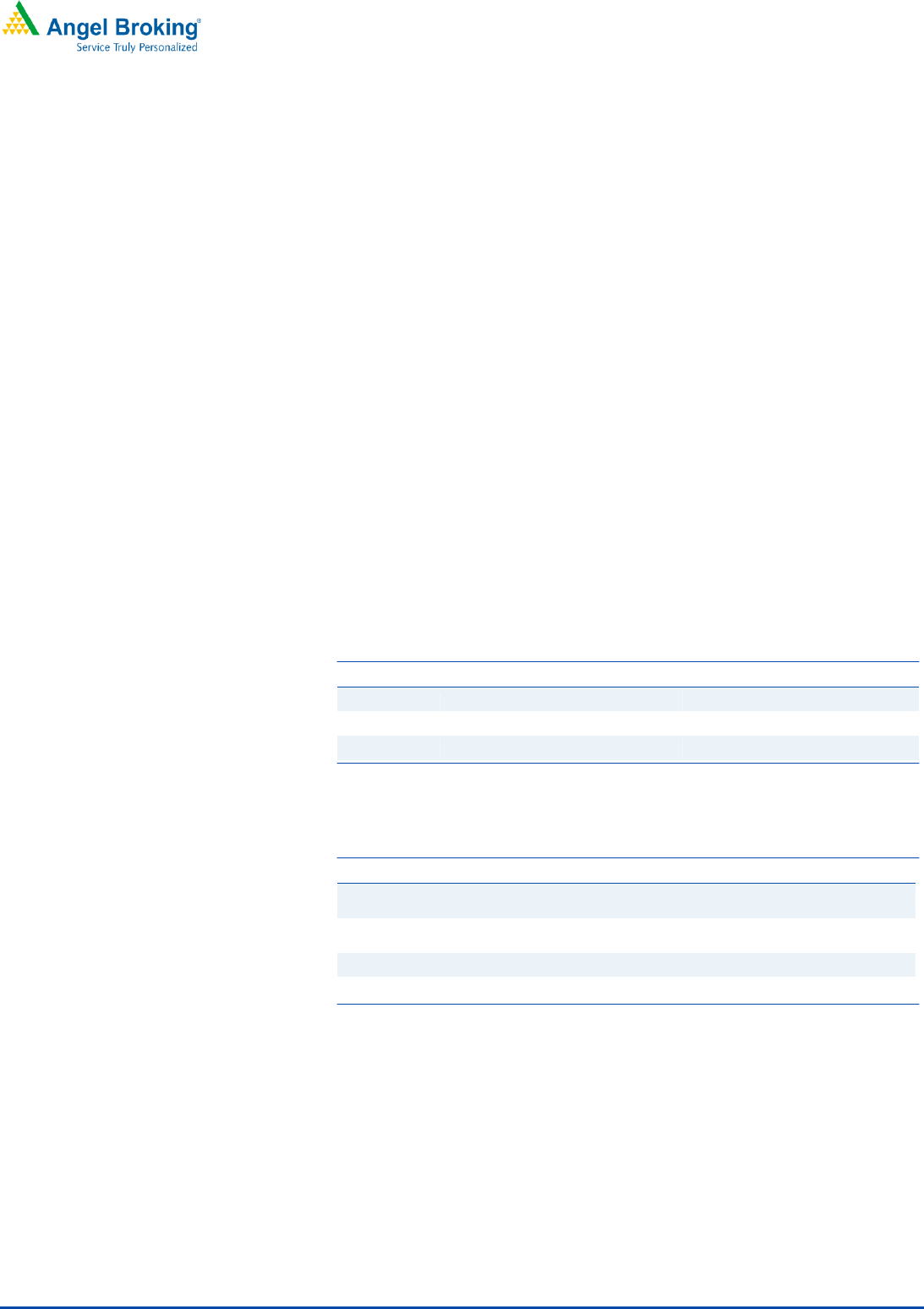

Pre and Post-IPO shareholding pattern

No of shares (Pre-issue)

%

No of shares (Post-issue)

%

Promoter (GOI)

1,92,33,453

96%

1,63,33,453

70%

Other

8,45,340

4%

70,01,154

30%

Total

2,00,78,793

100%

2,33,34,670

100%

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

Description

Amt. Rs cr

Prepayment or repayment of all or a portion of certain borrowings availed by

the company

21

Early redemption of the 9.8% fully redeemable cumulative preference shares

(“FRCPS”)

11.5

Long term working capital

20

General Corporate Purposes

-

Source: RHP, Angel Research

Outlook & valuation:

In terms of valuations, PE works out to be 31x annualized FY19 EPS of `7 post

listing (at the upper end of the issue price band) and there is no listed peer

available with similar products for comparison. Moreover, NCL is operating at

optimum level of utilization and company has not planned any capacity

expansion in near term. Therefore we believe investors should wait for price

discovery before taking any investment decision. Hence, we have NEUTRAL view

on the issue.

3

April

22,

201

NCL | IPO Note

April 22, 2019

3

Key Risks

Operates and manufacture hazardous chemicals

NCL’s manufacturing process involves the use of hazardous and flammable industrial

chemicals which entails significant risks and could also result in enhanced compliance

obligations.

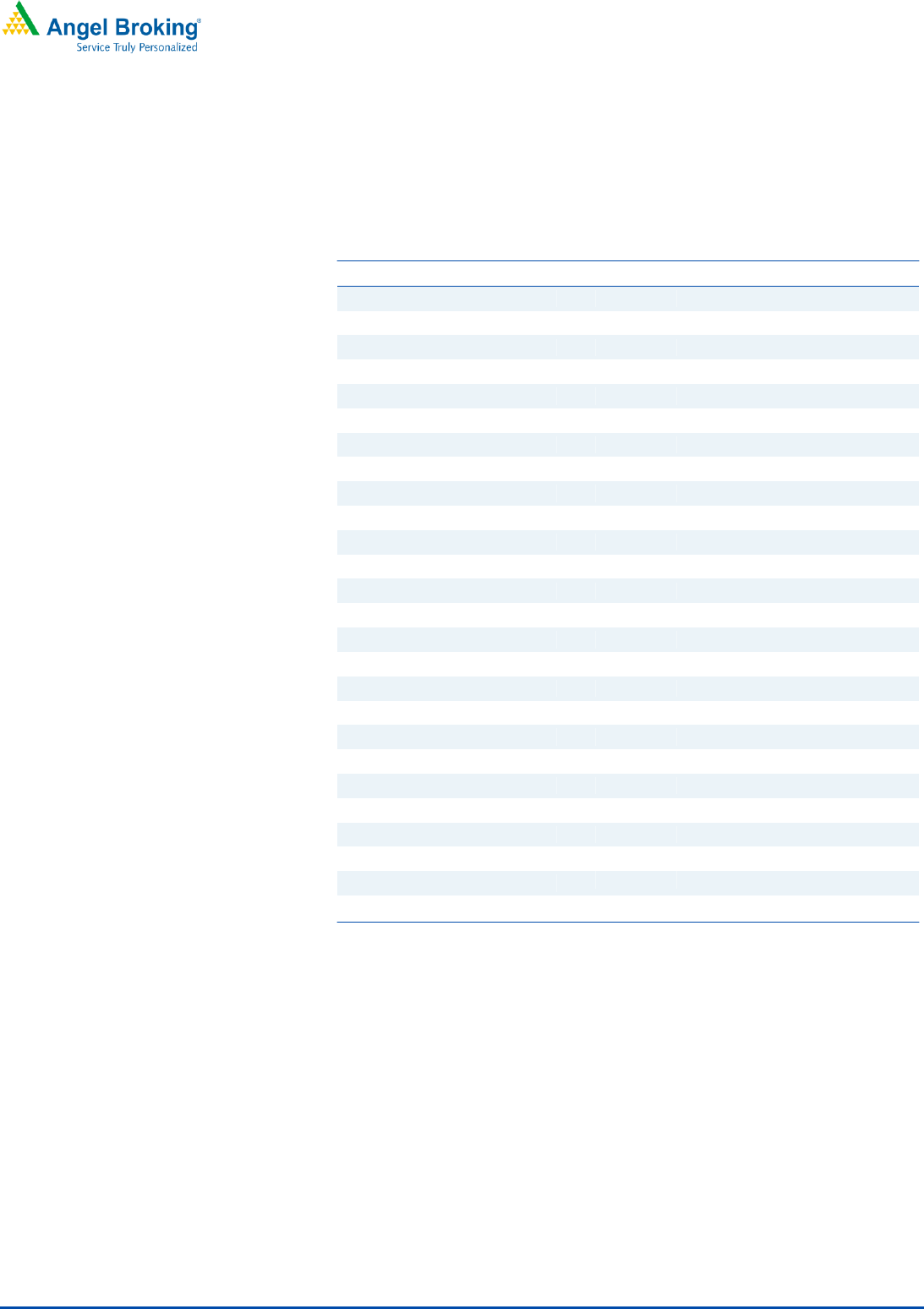

Income Statement

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E*

Total operating income

91

109

121

164

212

% chg

-

19

12

35

29

Total Expenditure

79

95

101

135

173

Raw Material

50

61

64

95

122

Personnel

5

5

5

9

11

Others Expenses

24

29

32

31

40

EBITDA

13

14

20

29

39

% chg

-

11

42

45

36

(% of Net Sales)

14

13

16

18

19

Depreciation& Amortization

1

1

1

2

3

EBIT

12

13

19

27

37

% chg

-

12

42

45

35

(% of Net Sales)

13

12

15

16

17

Interest & other Charges

5

5

8

10

11

Other Income

1

0

0

1

1

(% of PBT)

12

2

3

4

3

Extraordinary Items

0

0

0

1

2

Share in profit of Associates

-

-

-

-

-

Recurring PBT

8

8

11

16

24

% chg

-

5

35

42

46

Tax

3

3

4

7

10

PAT (reported)

5

5

8

9

14

% chg

-

2

48

24

51

(% of Net Sales)

6

5

6

6

7

Basic & Fully Diluted EPS (Rs)

2

2

3

4

7

% chg

-

2

48

37

57

Source: Company, Angel Research

Note *Annualized number

4

April

22,

201

NCL | IPO Note

April 22, 2019

4

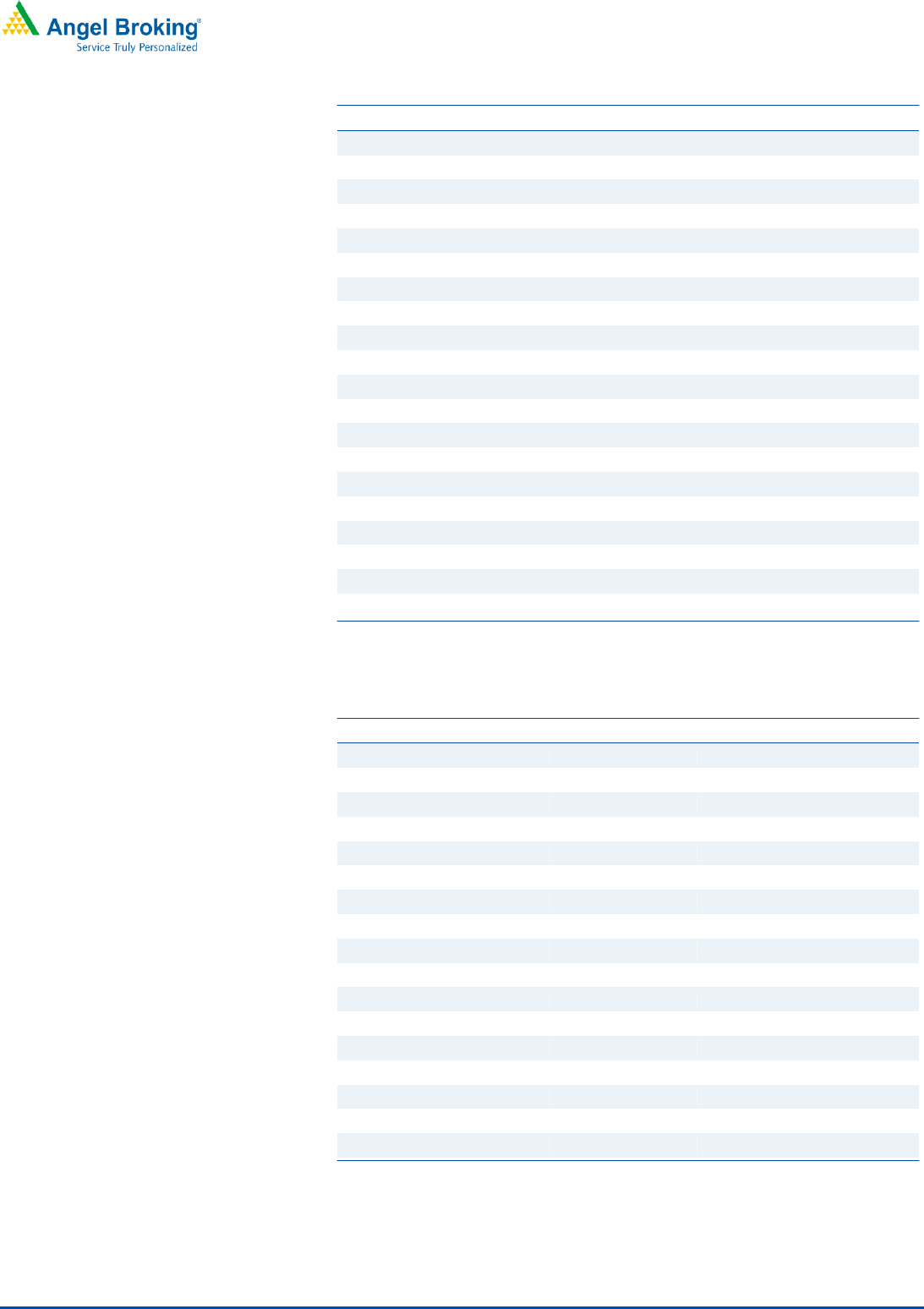

Balance Sheet

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E*

SOURCES OF FUNDS

Equity Share Capital

4.5

20.0

20.0

20.0

20.1

Reserves& Surplus

19.0

7.5

22.0

30.1

41.4

Shareholders’ Funds

23.5

27.5

42.0

50.1

61.5

Total Loans

7.3

7.4

43.8

46.4

52.4

Other Liab & Prov

0.0

0.0

0.0

0.0

0.0

Total Liabilities

30.8

34.9

85.7

96.5

113.9

APPLICATION OF FUNDS

Net Block

13.2

17.4

56.3

66.7

81.1

Capital Work-in-Progress

0.1

0.7

1.3

1.4

0.0

Investments

0.0

0.0

0.0

0.0

0.0

Current Assets

53.1

60.9

89.7

106.8

149.1

Inventories

24.3

31.8

40.0

50.0

77.2

Sundry Debtors

18.0

15.8

32.2

41.4

42.5

Cash & Bank

2.4

2.5

3.1

1.8

1.0

Other Assets

0.9

1.4

4.4

4.2

6.5

Current liabilities

38.0

45.6

66.6

83.6

123.5

Net Current Assets

15.1

15.3

23.1

23.2

25.6

Other Non Current Asset

1.4

0.1

0.6

1.1

0.7

Total Assets

30.8

34.9

85.7

96.5

113.9

Source: Company, Angel Research

Cash Flow

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19*

Profit before tax

8.1

8.5

11.5

17.3

17.0

Depreciation

0.9

1.0

1.3

1.9

2.1

Change in Working Capital

(2.0)

(2.8)

(14.9)

(13.4)

(31.5)

Interest / Dividend (Net)

(0.2)

(0.2)

(0.2)

(0.3)

(0.1)

Direct taxes paid

(2.6)

(3.1)

(3.9)

(4.0)

(2.6)

Others

4.4

5.3

6.5

10.2

8.7

Cash Flow from Operations

8.7

8.6

0.2

11.8

(6.3)

(Inc.)/ Dec. in Fixed Assets

(2.2)

(4.0)

(32.4)

(13.9)

(17.1)

(Inc.)/ Dec. in Investments

0.4

(0.4)

(0.5)

1.2

(0.2)

Cash Flow from Investing

(1.8)

(4.4)

(32.9)

(12.7)

(17.3)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(1.8)

1.7

29.6

12.0

33.4

Others

(4.5)

(5.9)

3.8

(12.5)

(10.6)

Cash Flow from Financing

(6.3)

(4.1)

33.3

(0.4)

22.7

Inc./(Dec.) in Cash

0.6

0.1

0.6

(1.3)

(0.8)

Opening Cash balances

1.8

2.4

2.5

3.1

1.8

Closing Cash balances

2.4

2.5

3.1

1.8

1.0

Source: Company, Angel Research

5

April

22,

201

NCL | IPO Note

April 22, 2019

5

Valuation Ratios

Y/E March

FY15

FY16

FY17

FY18E

FY19E

Valuation Ratio (x)

P/E (on FDEPS)

98.7

96.9

65.6

48.0

30.7

P/CEPS

83.3

81.2

56.0

40.5

26.1

P/BV

21.4

18.2

12.0

8.6

7.0

EV/Sales

5.6

4.7

4.5

3.3

2.6

EV/EBITDA

40.3

36.2

27.4

18.9

14.1

EV / Total Assets

16.6

14.6

6.4

5.7

4.9

Per Share Data (Rs)

EPS (Basic)

2.5

2.6

3.8

5.2

8.2

EPS (fully diluted)

2.2

2.2

3.3

4.5

7.0

Cash EPS

2.6

2.6

3.8

6.2

9.6

DPS

0.4

0.4

0.2

1.4

1.3

Book Value

10.1

11.8

18.0

24.9

30.6

Returns (%)

ROCE

38.1%

37.6%

21.8%

28.0%

32.1%

Angel ROIC (Pre-tax)

42%

41%

23%

29%

32%

ROE

21.7%

18.8%

18.2%

20.9%

26.7%

Turnover ratios (x)

Asset T/O

6.9

6.2

2.2

2.5

2.6

Inventory / Sales (days)

97

106

120

120

120

Receivables (days)

72

53

97

97

97

Payables (days)

65

73

93

93

93

Working capital cycle (ex-cash) (days)

103

86

124

124

124

Source: Company, Angel Research

6

April

22,

201

NCL | IPO Note

April 22, 2019

6

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

NCL

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No